The low earner Liberal Democrats

Yesterday Lib Dem Voice ran an op-ed from the Resolution Foundation’s Sophia Parker about the, “9.4 million working-age ‘low earners’ – those people living on an average household income of £15,800 while remaining broadly independent of state support.”

It’s a group of people that is not that often explicitly addressed in Liberal Democrat policy debates or campaigning and messaging discussions, expect in as much as they are part of the millions who would benefit from the party’s policy of raising the income tax threshold to £10,000.

Yet these low earner households have been the bedrock of many of the party’s biggest electoral successes in the last decade. The party’s control of a string of large cities – Liverpool, Sheffield, Newcastle, Bristol and so on – has often rested heavily on the support from ‘low earner Liberal Democrats’.

Other elements of that coalition for urban success often get attention. How does the party continue to best appeal to the ex-Tory voters in more affluent parts of those cities won over in the past by a mix of tactical voting and dislike of the pre-1997 government? How can the party keep the support of young graduates won over by the party’s stance on the Iraq war? Is the party saying enough on the environment to retain the votes of the Mosaic Urban Intelligence categories? And so on.

But often very little is said about the low earner Liberal Democrats. Consider how rarely the housing situation for renters, rather than those with mortgages, gets a mention.

The Resolution Foundation’s analysis of the group in general is a good starting point for looking at this group:

They are:

- Squeezed: often too poor to benefit from the full range of opportunities provided by private markets but too rich to qualify for substantial state support;

- Exposed: living at the edge of their means and therefore vulnerable to changes in circumstances; and

- Overlooked: low earners are not well-defined as a group and the pressures they face are not well understood.

They can be defined as:

- Household income: first qualification is presence in income deciles 3-5 (income measured on equivalised, gross and disposable bases depending on detail provided by source), and

- Benefit-receipt: second qualification is independence from state support (independence defined as obtaining less than 20 per cent of total income from income-related benefits)

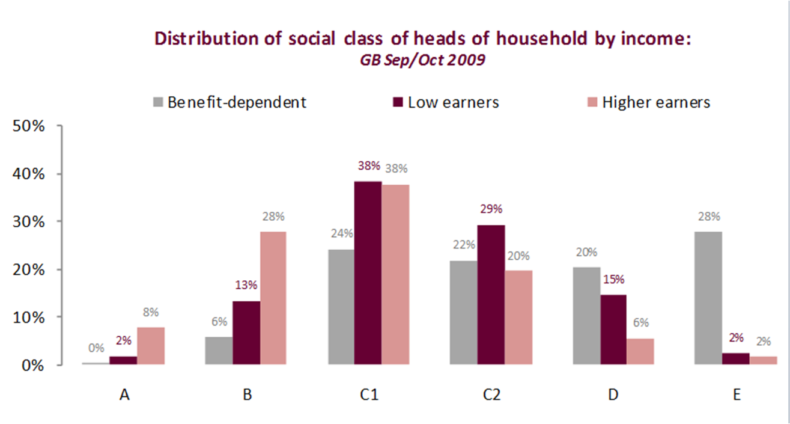

There are 7.2 million households who meet this definition (28% of all households), over two-thirds of whom are in social classes C1 and C2:

It’s a group of people for whom the Liberal Democrat policy of raising the income tax threshold to £10,000 is particularly well-suited to, because they usually spend all their disposable income each week, have low levels of savings and due to work patterns have variable levels of income from week to week.

As a result, Labour’s preference for tax-credits often makes for a sluggish and bureaucratic system which easily gets out of step with their personal situations – and when errors are made, people do not have the cushion of savings to see them through. That’s why taking people out of income tax brings about more than just the usually discussed benefits. As I wrote previously:

There is a major benefit which doesn’t get counted in pounds and pence in your pocket from being taken out of the income tax system – if you are the sort of person who struggles to handle complicated bureaucracy, who moves in and out of jobs through the year, who doesn’t have the financial cushion to see them through while tax takes are adjusted and over/under payments come and go. Or indeed, if you’re the sort of person for whom all of that applies.

(It’s a point which, incidentally, the Fabian Society seems curiously reluctant to fully embrace when it’s been looking at the Lib Dem tax plans. Yet it’s only the combination of tax systems and how they work in practice that determines the money in people’s pockets. To neglect the question of how they work in practice – the over-payments, the under-payments, the stress caused by paperwork, the sudden changes in tax codes and more – risks putting theory above reality.)

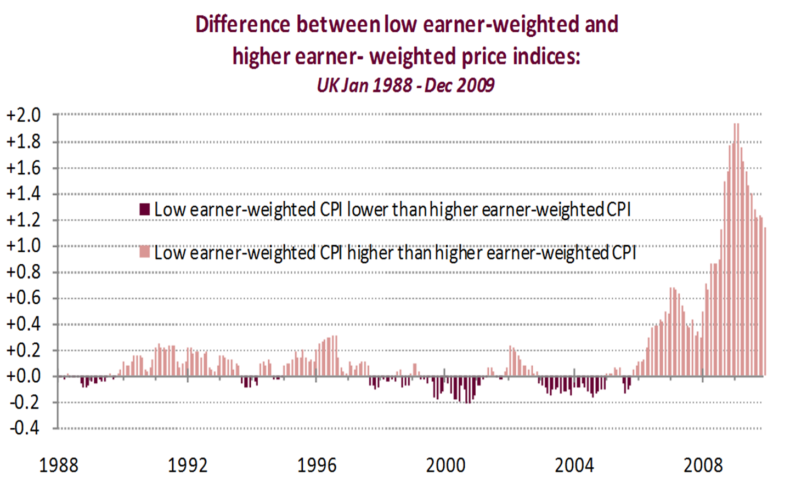

Low earner households have also often been particularly hit by rising prices, as food and fuel takes up a larger part of their expenditure that it does for better off households:

When it comes to housing, rental property plays an important role. Overall nearly three-quarters of low earner households are homeowners, but rates are much lower among younger low earners and, in the youngest age group, 43 per cent live in private rented sector.

There is much more that could be said about this group of people, but – with a general and local elections so near – there is also the obvious question: what does this mean for campaigning?

Here are three personas who capture the range of low earner Liberal Democrats:

Chris

- Works full time

- Separated from wife but can’t afford to move out>

- Lost eligibility for tax credits

- Taken a second job, looking for a third

- Can’t buy new shoes for children

- No money for self – no socialising, no eye test

- Avoids credit

- Saves with a credit union but unexpected costs – like new washing machine or bank charges – eat into this

- Doesn’t want to think about the future

Jane

- Renting from housing association

- Husband left last year, significantly reducing her income

- Lost job as part time assistant when shop closed

- Visits jobcentre twice a week, searches websites and asks around in shops/businesses

- Available jobs require three years’ relevant experience or NVQ Level 2, 3 or 4 – only has NVQ 1

- Became unwell – depression and anxiety

- Sold car – limiting her job prospects

- Must choose between heating and eating

- Lives hand-to-mouth and feels worthless

Julie

- Works full time as an agency carer

- Lives in privately rented flat with partner

- On council waiting list for five years

- Doesn’t like where she lives, but can’t afford to move

- Not much leftover after rent and bills – no prospect of buying a property

- Before meeting her partner she lived with her daughter because couldn’t afford to live alone

- Grand-daughter gave up her room, so she felt like she was intruding

- Worried that landlord might sell – they’re at his mercy

Leaf through your leaflets and news releases: are there messages in there that will appeal to them? On some points, almost certainly – especially the £10,000 income tax threshold policy.

But many of these concerns either are covered by party policy which is rarely talked about (such as improving the rental sector) or are ones that, at least online, are often abruptly dismissed by some (think how often issues such as a woman’s feeling of self-worth are dismissed as trivial, irrelevant or non-existent by male commenters).

Chris, Jane and Julie do get their rightful attention from some in the party; why not encourage others in your local party to add themselves to those ranks too?

Thanks to the Resolution Foundation for supplying the graphs and some of the information used in this piece.

Leave a Reply